Earning money is just one part of the equation; how you handle and manage that money is what truly leads to financial freedom.

Proper management involves budgeting, saving, investing wisely, and being mindful of expenses.

If you want to have good financial health, creating a budget is the best place to start.

It helps you to understand where your money is coming from, where it’s going, and how you can prioritize spending to align with your financial goals.

At first, it can be scary to dive into budgeting. I’ve been there!

It feels like this massive, complicated thing. All these terms and numbers can overwhelm anyone. And let’s be real, we all feel pretty attached to our cash, right? Plus, life loves throwing curveballs, making it feel even tougher.

This comprehensive beginner-friendly budgeting guide is here to help you get ahead of your doubts and make an effective budget that suits you and your dreams.

What is Budgeting?

Budgeting is a financial planning process that involves creating a detailed plan for how you’ll manage your money.

It typically involves estimating your income and expenses over a certain period, like a month or a year, to ensure you’re allocating your resources effectively.

Importance of Budgeting

Think of budgeting as your money’s GPS. It does a bunch of cool stuff:

- Shows Where Your Money Goes: Ever wondered where all your money disappears? Budgeting helps track every dollar so you know exactly where it’s going.

- Makes Dreams Happen: You know those things you really, really want? Budgeting helps you save up for them! Whether it’s a trip, a new phone, or something bigger like a car, you can plan and make it happen.

- Keeps Debt Away: Overspending can lead to debt. Budgeting helps you stay in your financial lane and avoid those debts.

- Emergencies: Life’s full of surprises. With a budget, you’ll stash away some cash for those unexpected moments, like a car breakdown or sudden medical bills.

- Less Stress: Money worries are a huge stress trigger. But when you’ve got a budget, you feel more in control and less stressed about money stuff.

- Secures Your Future: Thinking long-term? Budgeting isn’t just about now; it’s about making sure you’re set up for a comfy financial future. Like setting up a solid game plan for the long run!

Myths about Budgeting that are holding you back from becoming financially free

So, there are quite a few myths about budgeting that might be holding you back from taking the first step toward financial freedom.

For example, some people think only those struggling with money need to budget, but it’s useful for EVERYONE. Think of it as a way to handle money smarter, no matter how much you make.

Oh, and here’s another one: people assume budgeting needs to be this big, complicated thing with spreadsheets and fancy software. But really, it can be as simple as jotting down what you earn, what you spend, and what you want to save.

Another misconception is that if your income is irregular, budgeting won’t work for you. But it totally can! You just have to be flexible and work with averages instead of fixed amounts.

Also, some think once you set a budget, it’s set in stone. But life changes, right? Your budget can too. It’s all about staying flexible.

Remember, budgeting is just a tool to help you manage your money better, reach your goals, and live the life you want. It’s not a one-size-fits-all thing—it can match your lifestyle!

Getting Started

SET FINANCIAL GOALS

First things first, what are you aiming for? Think short-term, like getting rid of debt or saving for a vacation, and long-term, such as buying a house or retiring comfortably.

Start by figuring out what’s most important to you. Is it building an emergency fund, paying off loans, investing for the future, or all of the above? Once you’ve identified these priorities, break them down into specific, achievable goals.

For instance, if you want to save for a down payment on a house, calculate how much you need and by when.

Make sure these goals are SMART: specific, measurable, achievable, relevant, and time-bound. This way, you’ll have a clear target to work towards.

INCOME ASSESSMENT

For regular income

To calculate your total monthly or yearly income, you’ll want to gather all sources of money you receive

Start with your primary salary from your job. That’s your main income source. Add any bonuses or commissions you typically receive, like quarterly or annual bonuses.

Then, consider any side hustles or freelance gigs you have. If you earn money from freelance work, consulting, or any other side jobs, include those earnings too.

If you have investments or rental properties that generate income, don’t forget to factor in that as well. Any interest from savings accounts, dividends from stocks, or rental income contributes to your total income.

Other sources could include passive income streams, like royalties if you’ve written a book or created something that earns you money regularly.

Once you’ve gathered all these sources, add them up to get your total monthly income. If you want the yearly amount, simply multiply your monthly total by 12.

For irregular income

If your income is irregular, calculating your total monthly or yearly income might require a bit more effort, but it’s still doable!

For irregular income, start by looking at your earnings over the past year or several months. Add up all the income you’ve received from various sources during that period.

Then, find the average. Add up the total income and divide it by the number of months or the period you’re considering. This gives you an average monthly income.

Here is an example

This method helps smooth out the fluctuations in your income and gives you a more stable figure to work with. It’s a good approach to budgeting and planning when dealing with irregular income.

Additionally, it’s a good idea to set aside some money during months of higher earnings to cover expenses during lower-earning months.

UNDERSTAND YOUR EXPENSES

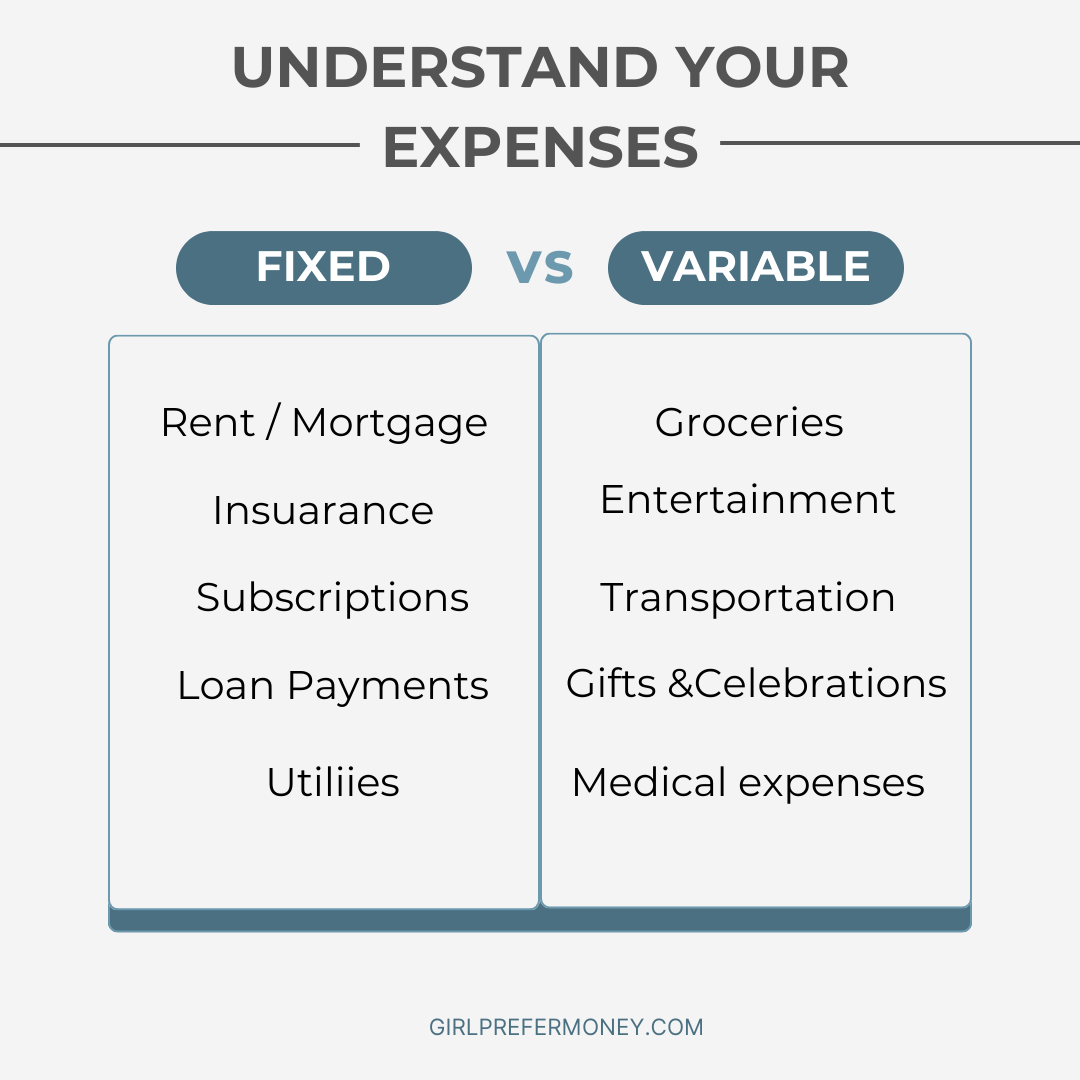

Fixed vs Variable Expenses

Fixed expenses are the bills and costs that pretty much stay the same month to month—things like rent or mortgage, insurance, subscriptions, and loan payments. They’re predictable and steady, making them easier to plan for.

Understanding these two types of costs helps you manage your money smarter. By knowing your fixed expenses, you’ve got a solid foundation—like the backbone of your budget. It lets you plan ahead and ensures you’re covering your essentials.

Variable expenses are where things get interesting. Keeping an eye on these helps you make adjustments as needed. Say, if you want to save more or cut back a bit, focusing on your variable expenses can give you wiggle room to play with.

PRIORITIZING EXPENSES AND ALLOCATING FUNDS

First up, make a list of your regular expenses. Start with the essentials like rent/mortgage, utilities, groceries, and any necessary bills. These are non-negotiables because they keep your life running smoothly.

Next, think about your financial goals. Do you want to save for something specific like a vacation or a new gadget? Or maybe you’re saving for a rainy day? Allocating funds for these goals is crucial too. Set aside a portion of your income towards achieving these objectives.

Once the essentials and your savings goals are covered, you can look at discretionary spending—things like dining out, entertainment, shopping, etc. This is where you have more flexibility. Try to allocate a reasonable amount for these while making sure it doesn’t jeopardize your financial stability.

Remember, adaptability is key. Unexpected expenses can pop up, so having a bit of wiggle room in your budget for emergencies is smart.

And always reassess! Life changes, so your budget might need adjusting. Maybe you got a raise, or your rent went up—these things can impact how you allocate funds.

CHOOSING A BUDGETING METHOD

Here are 6 ways to manage your money. Each one works differently depending on your preferences, your financial goals, and your lifestyle. So choose a method that will help you to manage your money in a way that aligns with your needs and wants.

1. ZERO-BASED BUDGETING

Definition and Core Principle

Zero-based budgeting (ZBB) is a budgeting method where you start from scratch every month. Unlike traditional budgeting where you might tweak last month’s budget, ZBB requires you to build your budget from the ground up, assigning every dollar a purpose.

The core principle here is pretty straightforward – justify every expense as if you’re starting fresh. It helps eliminate unnecessary spending and ensures that each expense is contributing to your financial goals.

It Will Work for You If…

Zero-based budgeting is great if you’re looking to gain control over your finances, cut unnecessary expenses, and allocate your money in a way that aligns with your priorities. It’s especially useful for those who want a detailed understanding of where their money is going.

Steps to Implement It

- Income Tracking: Start by determining your total income for the month. This includes your salary, side hustles, and any other sources of cash.

- List Your Expenses: Write down every single expense you anticipate for the month. This includes fixed bills like rent, utilities, and groceries, as well as variable expenses like entertainment or dining out.

- Assign Dollar Amounts: Give each expense a specific dollar amount based on what you realistically need.

- Adjust as Needed: If your expenses exceed your income, you’ll need to make some adjustments. Look for areas to cut back or eliminate entirely.

- Prioritize and Save: Allocate any remaining funds to your financial goals – whether that’s an emergency fund, debt repayment, or savings.

An Example

Let’s say your monthly income is $3,000. You allocate $1,000 for rent, $300 for utilities, $400 for groceries, and so on. If your total expenses add up to $2,800, you have $200 left. You could put that towards savings, paying off debt, or investing.

Remember, the goal is for your income minus expenses to equal zero, hence the “zero-based” part. It may take some time to get the hang of it, but it’s a powerful tool for financial awareness and control.

2. THE 50/30/20 RULE

Overview: Definition and Core Principle

So, the 50/30/20 rule is a budgeting strategy that breaks down your after-tax income into three categories:

- 50% for Needs: Allocate 50% of your income for essential expenses like rent/mortgage, utilities, groceries, and other necessities. These are things you can’t really do without.

- 30% for Wants: Dedicate 30% to your lifestyle choices and personal preferences. This includes non-essential spending like dining out, entertainment, hobbies, and that gym membership you love.

- 20% for Savings and Debt Repayment: The remaining 20% should be saved or used to pay off debts. This is crucial for building an emergency fund, saving for future goals, or tackling any outstanding debts.

It Will Work for You If… This rule is pretty flexible and can work for various income levels and lifestyles. It’s great for those looking for a simple, easy-to-follow budgeting strategy that encourages saving while allowing for some fun spending.

Steps to Implement It

- Calculate Your After-Tax Income: Start with the money you take home after taxes.

- Divide Into Categories: Allocate 50% to needs, 30% to wants, and 20% to savings and debt repayment.

- Stick to It: Be disciplined. Track your spending and adjust as needed. If you overspend in one category, try to make it up in another.

An Example

Let’s say your monthly income after taxes is $3,000:

- $1,500 (50%): Needs (rent, utilities, groceries)

- $900 (30%): Wants (dining out, entertainment, hobbies)

- $600 (20%): Savings and Debt Repayment (emergency fund, paying off credit cards)

This way, you’re covering your essentials, enjoying some personal indulgences, and securing your financial future.

Remember, it’s a guide, not a strict rule. Life happens, and flexibility is key. Adjustments may be necessary, especially when circumstances change.

3. ENVELOPE SYSTEM

Overview: Definition and Core Principle

The Envelope System is a budgeting method where you allocate a specific amount of cash for different spending categories and keep that cash in separate envelopes. The core principle is simple: once the cash in an envelope is gone, you stop spending in that category until the next budgeting period.

It will work for you if…

This system is great if you’re looking for a tangible and visual way to control your spending. It’s especially effective for people who struggle with overspending on things like groceries, entertainment, or dining out. If you prefer using cash over cards and like the idea of physically seeing how much money you have left for each category, the Envelope System could be a game-changer.

Steps to Implement It

- Identify Your Spending Categories: List out your regular spending categories, like groceries, dining out, entertainment, etc.

- Set Budgets: Determine a realistic budget for each category based on your income and financial goals.

- Withdraw Cash: Take out the total amount of cash you’ve budgeted for the month.

- Allocate Cash to Envelopes: Divide the cash into envelopes for each spending category. Label each envelope with the category name.

- Stick to the Plan: When you need to make a purchase in a specific category, use only the cash from that envelope. Once the cash is gone, that’s it for the month in that category.

An Example

Let’s say your monthly grocery budget is $300. At the beginning of the month, you take out $300 in cash and put it in the “Groceries” envelope. As you shop for groceries throughout the month, you only use the cash from that envelope. When the $300 is gone, you wait until the next budgeting period to refill the envelope.

This method helps you avoid overspending, stay on track with your budget, and gives you a tangible way to manage your money.

4. PAY YOURSELF FIRST

Definition and Core Principle

Paying yourself first means setting aside a portion of your income for savings or investments before using that money for anything else. The core principle is to make saving a non-negotiable part of your budget, treating it as an essential expense.

It Will Work for You If

This approach is beneficial for anyone looking to build a savings habit, create an emergency fund, or work towards specific financial goals. It’s especially effective if you find it challenging to save consistently.

Steps to Implement It:

- Determine a Percentage: Decide on a percentage of your income that you can comfortably set aside. It could be 10%, 20%, or any other amount that works for you.

- Automate Savings: Set up automatic transfers to your savings or investment account. Treating it like a monthly bill ensures that you consistently pay yourself first.

- Budget Around Savings: Consider your savings as a fixed expense, just like rent or utilities. Plan your spending around this committed savings amount.

- Avoid Excuses: Don’t let expenses or unexpected bills be an excuse to skip paying yourself first. Stick to your savings commitment as much as possible.

An Example

Let’s say you earn $3,000 per month, and you decide to pay yourself first by saving 15%. That means you set aside $450 every month before spending on anything else. If you automate this process, that $450 goes straight into your savings or investment account, making it a consistent and disciplined approach.

By adopting the “pay yourself first” mentality, you’re building financial security and working towards your goals without relying on whatever money is left after expenses. It’s a friendlier way to approach your finances, ensuring your future self gets a priority seat in your budget!

5. VALUE-BASED BUDGETING

Definition and Core Principle

Value-based budgeting is a budgeting technique where you prioritize and allocate your money based on your personal values and priorities. The core principle here is to spend consciously on things that truly matter to you, rather than just following a generic budget.

It Will Work for You If

This approach is perfect if you want your money to reflect your values and goals. If you’ve ever felt like your spending doesn’t align with what’s important to you, value-based budgeting might just be the missing piece.

Steps to Implement It:

- Identify Your Values: Take some time to think about what truly matters to you. It could be anything from family and health to personal development or travel.

- Set Financial Goals: Once you know your values, set specific financial goals that align with them. This could include saving for a family vacation, investing in education, or building an emergency fund.

- Categorize Your Spending: Break down your expenses into categories, like groceries, entertainment, and utilities. Assign each category to a specific value that it aligns with.

- Allocate Budget According to Values: Distribute your income among these categories based on your values. Allocate more to categories aligned with your top priorities and less to those that don’t resonate as much.

- Regularly Review and Adjust: Life changes, and so do priorities. Regularly review your budget, make adjustments as needed, and celebrate your progress.

Example

Let’s say one of your top values is health. In your value-based budget, you might allocate a significant portion of your income to categories like organic groceries, gym memberships, or wellness activities. On the other hand, if entertainment is not a top priority, you might allocate less money to dining out or streaming services.

In a nutshell, value-based budgeting is about being intentional with your money, ensuring it aligns with what matters most to you. It gives you a sense of control and satisfaction, knowing that your hard-earned cash is supporting the things you truly value.

6. THE 80/20 BUDGET

Definition and Core Principle

The 80/20 budget, also known as the Pareto Principle, is based on the idea that 80% of your outcomes come from 20% of your efforts. Applied to budgeting, this means focusing on the essential aspects that have the most significant impact on your financial well-being.

It will work for you if…

This budgeting strategy can work well for anyone looking for a straightforward method to balance their spending, savings, and personal enjoyment. It’s especially beneficial if you want to prioritize your financial goals while still allowing room for some guilt-free spending.

Steps to Implement It:

- Calculate Your Monthly Income: Start by figuring out your total monthly income.

- Determine Essential Expenses (80%): Identify the critical areas where your money needs to go, like bills, rent or mortgage, groceries, utilities, and debt payments. Make sure these essentials don’t exceed 80% of your income.

- Allocate 20% to Savings and Enjoyment: Take the remaining 20% and divide it between savings and discretionary spending. This could include saving for emergencies, retirement, or other financial goals, as well as funds for activities you enjoy, like dining out, entertainment, or hobbies.

- Track Your Spending: Keep a close eye on your expenses to ensure you stay within the 80/20 framework. Use apps, spreadsheets, or budgeting tools to monitor where your money is going.

- Adjust as Needed: Life happens, and priorities may shift. Be flexible and adjust your budget accordingly. The key is to maintain the 80/20 balance over time.

For example: Let’s say your monthly income is $4,000. In this case:

- 80% (essential expenses) = $3,200

- 20% (savings and enjoyment) = $800

So, you’d allocate $3,200 for necessities like bills, groceries, and debts, and the remaining $800 for savings and discretionary spending on things you love.

Advanced Budgeting Strategies for Growth

Saving and investing within the budget

This is a key aspect of financial growth. By setting aside a portion of your income for savings and investments within your budget, you’re essentially ensuring that your money isn’t just sitting idle but is working to generate more wealth for you.

Whether it’s putting money into a retirement account, stocks, bonds, or other investment vehicles, this approach can help your wealth grow over time.

Building an emergency fund and long-term savings

Having an emergency fund is like having a safety net. Life can throw unexpected curveballs, and having money set aside specifically for emergencies can prevent you from derailing your financial progress.

Simultaneously, having long-term savings goals (like buying a house, funding education, or retirement) and setting aside funds consistently for these goals is a powerful way to ensure you’re making progress toward larger financial milestones.

Exploring additional income streams

This is about diversifying your income sources. Relying solely on one job or income stream can be risky. Exploring side hustles, investments, or passive income opportunities can not only increase your overall income but also provide a cushion against unexpected financial challenges. It’s like planting multiple seeds to ensure a more bountiful harvest.

Revising the Budget During Life Changes

Life changes can be exciting but also demand a budgeting makeover. If you’re tying the knot, having a kid, or facing a job loss, reassess your budget. Factor in new expenses, adjust your savings goals and maybe reallocate funds to prioritize what matters most in your current life stage.

Communication is key, especially if you’re budgeting with a partner. Make sure you’re on the same page and working towards common financial goals.

Seeking Help or Advice

Budgeting can be a puzzle, and it’s okay to ask for help. Consider consulting with a financial advisor. They can provide personalized advice based on your specific situation and help you create a roadmap for financial success.

Community resources and support groups can also be fantastic. Sometimes, chatting with friends or family about their budgeting strategies can offer valuable insights.

Remember, there’s no one-size-fits-all solution, and it’s perfectly fine to adjust your budgeting approach as your life evolves. The key is staying proactive and adapting to whatever comes your way.

- The bottom line

There you have it. A comprehensive, beginner-friendly guide to budgeting. I hope this guide is helpful for you! Let me know in the comments if you have any questions.